Explained: Reports Surrounding the Circulation and Withdrawal of Old Naira Notes in Nigeria

BY: Mustapha Lawal

The status of Nigeria’s old naira notes—whether they will continue to be in circulation or phased out—has sparked considerable confusion, rumours, and debate, involving both the Central Bank of Nigeria (CBN) and Nigeria’s House of Representatives.

Background: Why Old Naira Notes Are Still in Circulation

In 2022, the CBN under Godwin Emefiele, the former governor, implemented a naira redesign policy aimed at combating inflation, curbing currency hoarding, and encouraging a cashless economy. As part of this initiative, the CBN introduced redesigned 200, 500, and 1,000 naira notes, while also initially setting a deadline for the use of the old naira notes. The redesigned notes were unveiled on December 23, 2022 with a deadline for using the old notes as legal tender put at January 31, 2023, before it was extended to February 10 of the same year.

However, the policy met significant backlash, with many Nigerians facing difficulties in accessing the new currency. In February, a suit was initiated by some states, including Kaduna, Kogi, and Zamfara, challenging the implementation of the policy. The supreme court restrained the CBN from giving effect to the deadline, following an ex parte application brought by the three states. The supreme court faulted the apex bank’s policy, saying the timing and implementation were defective.

The policy caused severe hardship, leading to cash scarcity and protests across the country. Following public outcry and intervention by the Supreme Court, the CBN adjusted its stance, extending the deadline for using the old naira notes as legal tender. On November 19, 2023, the CBN said the old naira notes remain legal tender and will be used indefinitely.

In March 2023, the supreme court had extended the deadline to phase out old naira notes to December 31, 2023. However, on November 29, 2023, the supreme court ruled that old and new naira notes will co-exist as legal tender until further notice. This decision provided a longer window for the gradual transition from old to new currency notes and was meant to address the scarcity of the new notes in circulation.

Current Developments and Conflicting Statements

- House of Representatives Position:

Recently, the Nigerian House of Representatives re-entered the discussion calling for the withdraw of the old notes and circulation of the new notes. The Nigerian House of Representatives protend December 31, 2024, as the final deadline for old N200, N500, and N1,000 notes to cease being legal tender.

During Thursday’s plenary, the House passed a resolution instructing the Central Bank of Nigeria (CBN) to initiate public awareness campaigns regarding the deadline and order commercial banks to stop dispensing old naira notes to customers. This decision follows a motion by Afam Ogene, a Labour Party member from Anambra, who emphasized the need for timely sensitization to avoid a repeat of the 2023 naira redesign policy’s chaos.

Ogene argued that the Supreme Court’s ruling stipulated the withdrawal of old notes by January 1, 2025, but expressed concern that the CBN has not shown signs of preparing the public for this transition, stating, “The CBN ought to have started public awareness… but now with about two months to the deadline, there is nothing to show that the apex bank is prepared for the exercise.”

However, the last discussion on this subject was the supreme court ruling of November 29, 2023 and an announcement by the CBN that old and new notes would coexist indefinitely as legal tender. Despite that, the House mandated the gradual removal of old notes and called for more new currency to be issued.

- CBN’s Position:

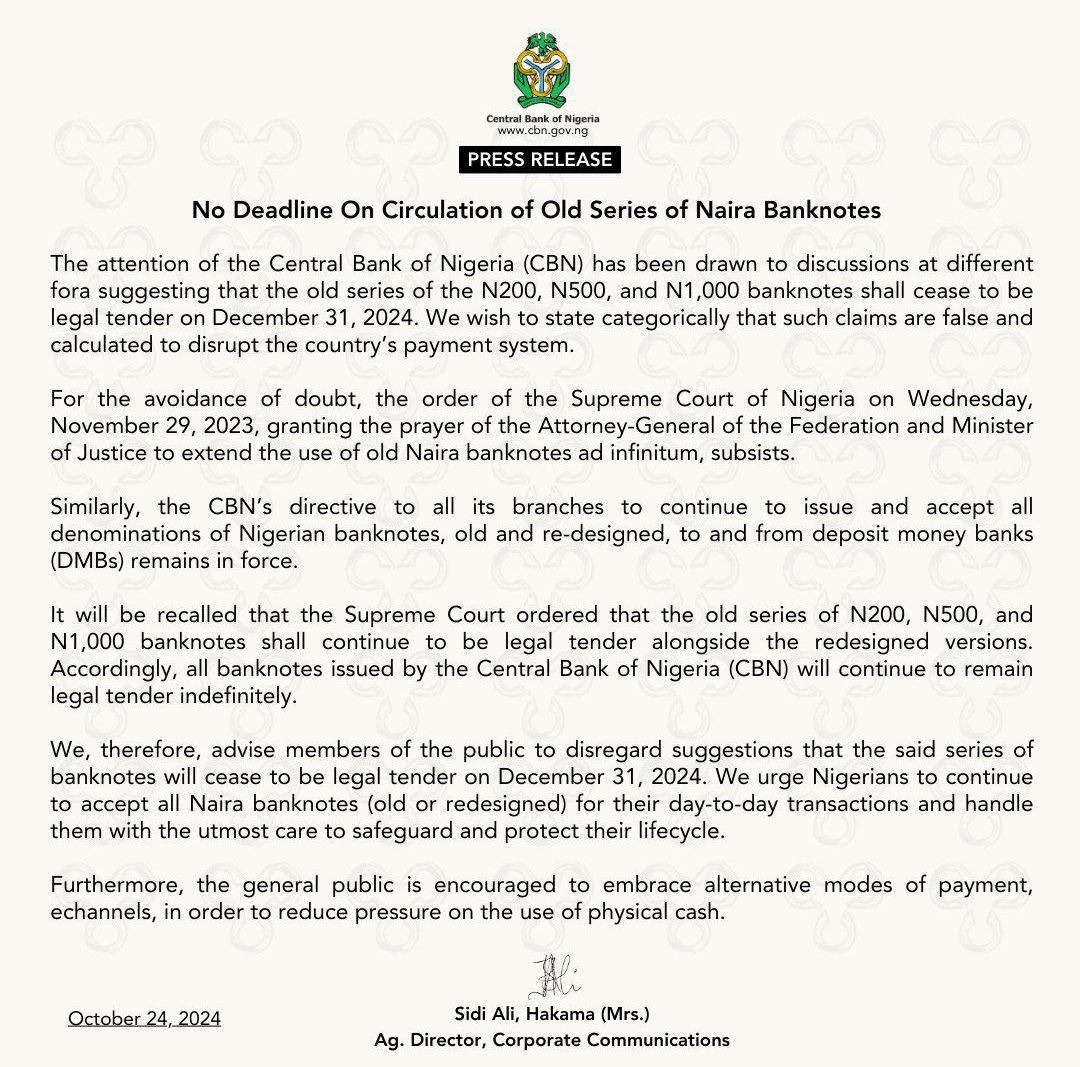

Contrary to the House’s stance, the CBN recently clarified that it has not set a new deadline for withdrawing old naira notes from circulation. The CBN in a statement issued by its acting Director, Corporate Communications Department, Mrs. Sidi-Ali, Hakama, said such claims by the House are “false and calculated to disrupt the country’s payment system”.

Photo Credit: Screenshot of the CBN statement

In the statement, the CBN maintained its stand on the legality of the old notes, warning that the directive to withdraw the old notes remains in the realms of rumour and intended to disrupt the country’s payment system. Mrs. Ali emphasized that the Supreme Court ruling on November 29, 2023, allowing the old banknotes to remain in circulation indefinitely remains valid.

Legal and Financial Implications

The apparent disconnect between the CBN and the House of Representatives on the naira deadline has legal, financial, and social implications:

- Legal Concerns: The Supreme Court’s ruling mandated that the old notes remain legal tender until indefinitely. While the CBN has adhered to this ruling, the House of Representatives’ recent call for a strict deadline could be perceived as conflicting with the court’s decision. According to Daily Trust, financial analysts argue that only the CBN has the authority to enforce currency policy changes, in line with the Supreme Court’s verdict.

- Economic Impact: A sudden withdrawal of old naira notes could create liquidity issues, affecting businesses, particularly in rural and unbanked areas where cash remains the primary means of transaction. On the other hand, failing to enforce a deadline could lead to a continued circulation of both old and new notes, which may complicate monetary policy and inflation control efforts.

- Public Confusion and Trust: The contradictory statements have left many Nigerians uncertain about the validity of old naira notes. In a country with limited digital infrastructure, especially in rural areas, clarity on currency use is crucial to avoid confusion and build public confidence in the banking system. Moreover, there has been a wind of misleading narratives being circulated across various platforms on this issue.

Public Response and Expert Opinion

The confusion surrounding the old naira notes has not gone unnoticed by the public. Many citizens have expressed frustration over the mixed messages and uncertainty. Financial experts caution that this lack of coherence could undermine public trust in Nigeria’s financial institutions.

Economic analyst Bisi Oladipo noted, “A coherent and unified stance is necessary to ensure that people have confidence in the naira and that businesses can plan their transactions with certainty.”

Additionally, some critics argue that the debate reflects a deeper issue within Nigeria’s financial governance, where multiple branches of government appear to lack coordination on critical policy matters.

What’s Next: Watch Points for Nigerians

Given the uncertainty, Nigerians are encouraged to monitor announcements from both the CBN and the House of Representatives closely. As of now, both the old and new naira notes remain valid, but stakeholders anticipate further clarification or possible adjustments by the CBN to avoid public confusion.

The issue surrounding the old and new naira notes reveals challenges within Nigeria’s approach to currency management and communication. The importance of a clear, coordinated strategy cannot be overstated, as the naira serves as a foundation of daily commerce for millions of Nigerians.

For now, citizens are urged to use both old and new naira notes as legal tender, pending any definitive directive from the CBN that aligns with the Supreme Court’s ruling. The onus remains on Nigeria’s financial institutions to provide clear, timely, and consistent communication, ensuring that the people are adequately informed and prepared for any currency policy changes ahead.