Fact-Check: False, GTBank is Not Opening Accounts in Customers’ Names As Widely Claimed by Netizens

BY: Oluwaseye Ogunsanya

Claim:

Series of posts on social media platforms suggests that Guarantee Trust Bank (GTB) is opening accounts in customers’ names without their approval.

Verdict:

False!

Full Text

Series of posts on social media platforms suggests that Guarantee Trust Bank (GTB) is opening accounts in customers’ names without their approval “in order to increase the customer base of the bank and shore up fictitious profits.”

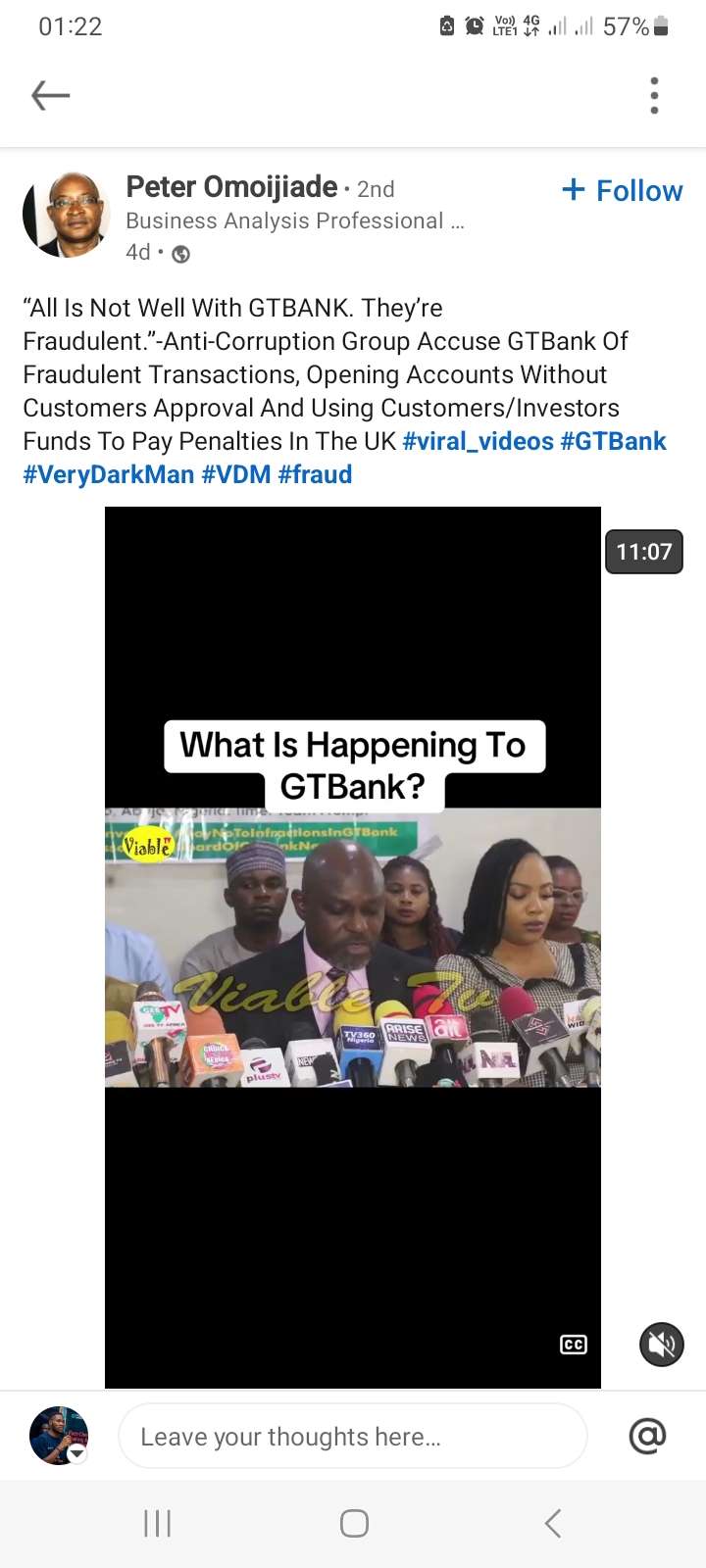

The posts which called GTBank “fraudulent” were accompanied with a 11 minutes video from a press briefing of a group of lawyers under the umbrella of Global Integrity Crusade Network (GICN). It can also be found here, here, here and here.

Screenshot of the video as seen on Linkedin

In the video the group’s president, Edward Omaga, Esq presented a private investigation report (PIR) accusing GTB, under the leadership of the Group Chief Executive Officer (GCEO), Segun Julius Agbaje, of alleged acts of corruption, unsolicited accounts opening, declaration of fictitious profits, round-tripping, money laundering, terrorism financing and use of customers/investors’ funds to pay penalties in the United Kingdom.

“One of the corrupt practices recently linked to Guaranty Trust Bank Limited in Nigeria has to do with unsolicited accounts opening. This is a situation where a customer did not approach the Bank or show any interest in maintaining an account with the bank.

“Yet, the bank goes ahead to source for the customer’s information such as telephone number, date of birth, Bank Verification Number (BVN) and other vital details to open account for the customer without his/her consent.

“The aim of this practice is to increase the customer base of the bank, thereby giving it high ranking in terms of size, capacity and profitability. We submit that unsolicited accounts opening tantamount to breach of data privacy, identity theft and can expose the innocent account holders to lots of financial crimes.

“As at today, there are over 10,000 customers in the database of Guaranty Trust Bank Limited who are already exposed to grave danger without their knowledge. Some of these customers have threatened to sue the Bank.

“We have equally uncovered that Guaranty Trust Bank Limited has been declaring profits that do not reflect its actual financial performance.” the statement reads in part.

Context

The allegation comes at a time when initial reports dominating the media space last Friday linked GTbank to the arrest of controversial social media commentator, Martins Vincent Otse known as VeryDarkMan (VDM). According to the reports, VDM had visited one of the bank’s branches in Abuja to lodge a complaint regarding alleged unauthorized transactions from his mother’s bank account.

However, Barrister Deji Adeyanju, a human rights lawyer on VDM’s legal team, dismissed the claim that GTBank was involved in VDM’s arrest.

“There is no connection between GTBank and the arrest of my client,” Adeyanju said. “It happened in an entirely different location and was conducted by state actors.” He clarified that the Economic and Financial Crimes Commission (EFCC) arrested VDM in Area 3, hours after his bank visit.

However, on Monday, EFCC spokesperson Dele Oyewale confirmed to BBC News Pidgin that the agency was responsible for VDM’s arrest adding that the EFCC is obligated to protect the identities and interests of those who lodged the complaints.

Mr Oyewale said, “We arrested him (VDM) to respond to a series of allegations raised against him by some petitioners. We will release him once he meets the bail conditions, and we will take the case to court as soon as possible. We are law-abiding.”

His arrest and subsequent detention sparked widespread controversy on social media, with several celebrities, including the 2023 Peoples Democratic Party presidential candidate, Atiku Abubakar, his Labour Party counterpart, Peter Obi, and popular singer, Davido, calling for his immediate release.

Similarly, Premium Times reported that some youths took to the streets of Abuja in the early hours of Monday to protest against the arrest of VDM. The protesters, carrying placards with various inscriptions, converged at the headquarters of GTBank in Abuja.

While a separate group of protesters also gathered in large numbers at a junction near the EFCC headquarters in Jabi. They described VDM’s arrest and detention as unlawful and demanded his immediate release.

The social media activist was later granted an administrative bail by the anti-graft agency on Tueday and subsequently released on Wednesday

Following VDM’s arrest and detention, the bank faced widespread backlash on social media—particularly on X (formerly Twitter)—for its alleged involvement. However, FactCheckAfrica observed that many of the criticisms included questionable claims, prompting this fact-check.

Verification

To verify the claim, FactCheckAfrica conducted a Google search to ascertain whether there are reports supporting the claim that GTBank is opening accounts in customers’ names without their approval.

Using Google Reverse Image Search, the result revealed that the video making the rounds first surfaced online in October 2024. Also, a further search led us to a statement issued on 4th October, 2024 by the bank debunking the claim.

According to the statement titled “Rebuttal of False News Reports Against GTCO’s Business Activities, Results and Its Executive Management”, GTCO said the news articles which centre around baseless allegations against the Group’s business activities and its Executive Management are false and are being sponsored using the media. The group also stated that it has taken swift and decisive legal actions against the various sources of these false reports, and will continue to use the full extent of the rule of law available to safeguard its reputation.

“Based on the incessant release of false news reports on GTCO’s business activities, Results and its Management Team, it has become necessary to set the records straight and dispel attempts by certain groups to create a false narrative about the GTCO Brand and its Management.

“The false news articles which are being sponsored using the media, center around baseless allegations against the Group’s business activities and its Executive Management.

“Being a responsible corporate citizen and a first class institution, GTCO Plc has taken swift and decisive legal actions against the various sources of these false reports, and will continue to use the full extent of the rule of law available to safeguard its reputation.

“We urge all our Customers, Shareholders and Stakeholders to kindly disregard all the allegations being peddled through various media platforms and handles. All of our Executive Management team continue to operate in their full capacities as appointed, and are not under any financial or regulatory scrutiny as alleged.

“Thank you for your continued support.” The statement reads.

Relatively, in a show of strong support for GTCO and move to debunk false allegations being levelled against the bank, the Central Bank of Nigeria also issued a Press Release reassuring the public that their deposits with Nigerian Banks are safe.

The Statement titled, “CBN Reaffirms Commitment to Financial System Stability, Safety of Depositors’ Funds” and signed by Ag. Director, Corporate Communications, Hakama Sidi Ali (Mrs.), among other things, assured the public of its unwavering commitment to ensuring the stability and reliability of the Nigerian financial system. The apex bank also stated that it recognises the crucial role that confidence plays in banking operations, affirming that all deposits in Nigerian banks are secure.

Furthermore, we also found a report by Daily Trust published in March which stated that Global Integrity Crusade Network (GICN), has retracted the allegations of corruption and unwholesome activities made in a Private Investigation Report (PIR) against Guaranty Trust Bank (GTB) Limited, a subsidiary of Guaranty Trust Holding Company Plc.

According to a statement signed by President of the organisation, Edward Omaga Esq., he stated that he presented the PIR to the media on 3rd October, 2024 and later submitted the same to certain agencies in Nigeria, UK, USA and Ghana for further action, adding that the documents relied upon to compile the PIR, were obtained from the internet and were baseless and do not depict the true state of affairs about GTB Limited and its management.

Conclusion

The claim that Guarantee Trust Bank (GTB) is opening accounts in customers’ names without their approval “in order to increase the customer base of the bank and shore up fictitious profits.” is false. The video which first surfaced on the Internet last October has been debunked by GTCO and CBN. Also, our findings show that the group that made the allegations have since retracted it.