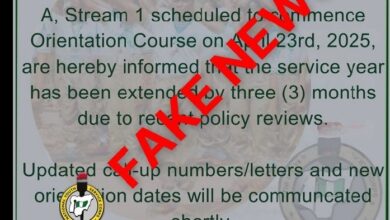

Fact-Check: Major Claims From Viral Video Regarding Tinubu Family’s Involvement in Nigeria’s Oil Industry

By: Rabiu Afeez

Claim: An X user @RayTilde posted a video clip with the audio in Hausa language running a commentary which asserts that the Tinubu family owns Oando Oil Company, recently acquired Agip Oil Company, and manages oil operations through Malta amongst other claims.

The post has since gathered 529.3 thousand views and tons of retweets, likes and comments since published on 5th of August 2024.

In a bid to verify this video, FactCheckAfrica analyzed 6 major claims from the assertions as translated to English language.

Fulltext: Transcript from the video: “Why is fuel price high in Nigeria? Let me explain, Tinubu and his family own Oando oil company. They recently bought Agip oil company in Nigeria, which is the sole owner of 17 oil blocks and produces 11 million barrels of oil annually. Therefore, these oil wells now belong to Tinubu and family. After drilling, oil is then refined into several products. Instead of refining the oil in Nigeria, Malta is chosen, a country that is not half the size of Lagos state in Nigeria. Question: why can’t Nigeria refine its own oil, but a small island that isn’t half the size of Lagos can supply our much-needed oil? In 2021, the largest fuel company in Malta called Enemed leased out its oil blending and storage facilities to Ras Hanzir. Who owns Ras Hanzir? Tinubu family under the care of Wale Tinubu and Adewale Tinubu Junior. Wale and Tinubu family are also the owners and managers of Oando and Agip Nigeria. Let’s recap. Tinubu family owns Oando, which acquired Agip and its oil wells in Nigeria. It then took a lease of Maltese blending and storage plants under Ras Hanzir. If you haven’t gotten confused yet, Ras Hanzir has now set up a refinery in Malta and bought the Maltese blending storage plants it once leased in 2021. Now the Tinubu family owns oil wells, a refinery, blending plants, and storage tanks. What’s left? Importing it to Nigeria. So as soon as he was inaugurated as the president, Tinubu’s first point of action was the removal of fuel subsidies. This will make him richer, yet he still secretly pays himself oil subsidies from the country’s coffers before completely removing it in the near future so you pay him the difference. He extracts the oil, sells it to himself, then exports it to Malta, refines, blends, and imports it back and sells it to you at foreign prices. On top of it, he pays himself oil subsidies. Here is the relationship of this tyranny with the dollar exchange rate. Nigeria gets most of its dollars from selling crude oil to foreign countries. So if Nigeria sells oil, it can bring those sufficient dollars back home and sell it, and the dollar rate will be low. But why do we have a dollar shortage in Nigeria? It is because we use the dollars earned from selling crude to buy refined petrol and fuel from abroad, and recently, most of it is from Malta. With more than 2 billion dollars in 2023, as a result, Nigeria won’t have sufficient dollars to bring back home to sell. This will make the dollar exchange high. But who now has a lot of dollars from selling crude oil and fuel and can bring back to Nigeria to sell at high prices? Tinubu and his family. Why Dangote? Why set up the biggest refinery project in the world in Lagos? Do you know how that will affect the price of fuel and dollars in Nigeria? Drop it in the comment section.”

Verification:

1: Tinubu and his family own Oando Oil Company?

Analysis: FactCheckAfrica through our MyAiFactChecker tool verified if Wale Tinubu is indeed related to Bola Ahmed Tinubu and the result shows that they are related. Adewale Tinubu, commonly known as Wale Tinubu, serves as the Group Chief Executive Officer at Oando. He has been at the helm of the company, steering its growth and diversification. Despite the relationship, there is no verifiable evidence that Bola Ahmed Tinubu and his family solely own Oando.

Oando PLC is one of Nigeria’s prominent energy companies, known for its extensive operations in the upstream, midstream, and downstream sectors. The company’s ownership structure is diverse, comprising various institutional and individual shareholders. This information aligns with publicly accessible data on Oando’s corporate governance and shareholder records. Claims suggesting a direct ownership link between Bola Ahmed Tinubu and Oando are unsubstantiated based on the available evidence.

2: Tinubu and his family recently bought Agip Oil Company in Nigeria?

Analysis: The Nigerian Agip Oil Company (NAOC) was indeed acquired by Oando Plc, a company led by Wale Tinubu, who is the nephew of President Bola Tinubu.

FactChcekAfrica can confirm that the company was not bought by the Tinubu family, but by a company run by a member of the Tinubu family. As reported by the Cable, Oando Plc says it has reached an agreement with Eni, on the acquisition of a 100 percent stake in its subsidiary.

There is no public record or verified news that confirms the acquisition of Agip (Nigerian Agip Oil Company Limited, a subsidiary of Eni) by the Tinubu family.

3: Malta refines Nigeria’s oil because Nigeria cannot refine its own oil?

Analysis: Nigeria has several refineries, but they have struggled with inefficiency and underutilization. This has led to the country exporting crude oil and importing refined products. Nigeria has indeed been importing petroleum products from Malta, but this does not necessarily mean that Malta is refining the entirety of Nigeria’s oil. A report by The Cable quoting Aliko Dangote states that there are blending plants in Malta, which can mix re-refined oil with additives to create finished products, but they do not have the capability to refine crude oil. This claim of importation of refined oil from Malta is also corroborated by various other publications from conventional media in recent times.

4: Enemed leased its oil blending and storage facilities to Ras Hanzir in 2021.

Analysis: Enemed is a Maltese company involved in fuel supply. There is no readily available public information linking Enemed’s facilities to a lease to Ras Hanzir, purportedly owned by the Tinubu family or Oando oil company. This association claim was recently refuted by Oando in a press statement released in July 2024. The company stated as quote: “we wish to refute such claims and attest that neither Oando PLC nor its Executives have ever held shares, investments, or interests in the said Maltese company.”

5: Wale Tinubu and Adewale Tinubu Jr. own and manage Oando and Agip Nigeria?

Analysis: As previously stated, using our verification tool MyAifactchecker, we were able to spool information from available data online that’ Adewale ‘Wale’ Tinubu is the group chief executive of Oando PLC. He led the acquisition of Unipetrol during the Nigerian Government’s privatization exercise in 2000, and later led the purchase of Agip Nigeria PLC, rebranding the group to Oando PLC in 2003. There is no mention of an Adewale Tinubu Jr. in the management or ownership of Oando or Agip Nigeria. Therefore, Adewale Tinubu Jr.’s involvement is not documented, and there is no verified ownership of Agip Nigeria by the Tinubu family.

6: Nigeria’s dollar exchange rate is adversely affected by importing refined oil instead of refining domestically?

Analysis: This claim is well-founded and shows a significant economic challenge. Our findings shows that the importation of refined oil appears to have a significant effect on Nigeria’s dollar exchange rate and overall economic stability. Factors such as changes in crude oil prices, deficits from importing non-oil products, and heavy reliance on imported petroleum products contribute to this issue.

As reported by conventional media, The constant outflow of dollars to pay for imported fuel puts pressure on the country’s foreign exchange reserves, leading to volatility in the exchange rate. A lower reserve level often results in a weaker naira against the dollar, exacerbating inflation and increasing the cost of goods and services.

According to the Central Bank of Nigeria (CBN), the strain on foreign reserves due to high importation of refined petroleum products is a primary factor in exchange rate instability. The CBN has documented the adverse effects of this dependence in its reports, emphasizing the need for improved domestic refining capacity to stabilize the currency and strengthen the economy.

Conclusion

The claims about the Tinubu family’s extensive involvement in Nigeria’s oil industry and manipulation of subsidies are largely unsubstantiated while some of the claims might be true, there is no documented evidence to prove the direct involvement of the Tinubu Family in the alleged scheme.

Verified data does not support ownership or strategic control of Oando, Agip, or Maltese oil operations by the Tinubu family as the excerpts claim.

Edited by Habeeb Adisa